The government today rolled back steep interest rate cuts on small savings schemes announced last evening, with Finance Minister Nirmala Sitharaman announcing that “orders issued by supervision” would be removed. Millions of middle-class depositors will have been harmed by the cuts to schemes like National Savings Certificates (NSC) and Public Provident Fund (PPF).

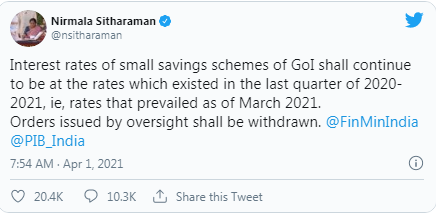

“The interest rates on the government of India’s small savings schemes will remain at the levels that prevailed in the fourth quarter of 2020-2021, i.e., as of March 2021. Orders released by supervision must be revoked “Nirmala Sitharaman, the Finance Minister, tweeted this morning.

As Bengal and Assam voted in the second round of state elections, the rollback was declared.

The government declared a major cut in interest rates of up to 1.1 percent for the first quarter of 2021-22 last evening, on the last day of the fiscal year. The PPF interest rate has been lowered from 7.1 to 6.4 percent. The NSC will decline from 6.8% to 5.9%.

The new PPF interest rate was set to be the lowest since 1974.

This would have been the second cut in interest rates on small deposits in a year if it had been enforced. The government cut small savings scheme prices by 0.70-1.4% in the April-June quarter of 2020-21.

According to reports, the government obtained and received the Election Commission’s no-objection certificate for the periodic review of interest rates before making the announcement in the middle of polls. According to sources in the election body, the government had announced that a quarterly review was expected.

For the first time, the interest rate on savings deposits was cut by 0.5 percent to 3.5 percent a year, down from the previous rate of 4%. On the one-year term deposit, the steepest drop of 1.1 percent will have been added. Instead of 5.5 percent, the current rate was 4.4 percent.

At 5%, a two-year fixed deposit would have earned 0.5 percent less, and a three-year term deposit would have earned 0.4 percent less. A five-year term deposit average of 5.8% will have been lower by 0.9 percent.